A Fremont sales tax calculator helps businesses and customers determine the total tax amount on a transaction by applying the current tax rates. This tool ensures Bookkeeping 101 accurate tax calculation based on the state, county, and special taxes, reducing the risk of errors and non-compliance. Fremont, California, has specific sales tax rates and regulations that businesses must adhere to for compliance. Understanding the breakdown of state, county, and local taxes is essential to accurately calculate and collect the correct amount.

- Some areas impose combined state, county, and city fees.

- Fremont Valley sales tax details The minimum combined 2026 sales tax rate for Fremont Valley, California is 8.25%.

- The applicable sales tax rate may vary depending on the type of purchase (e.g., goods, services, or special categories).

- This guide provides a detailed overview of Fremont sales tax, helping you stay informed with tax changes and compliant with California sales tax requirements.

- Sales Tax States shall in no case be held responsible for problems related to the use of data and calculators provided on this website.

- To help you identify the correct sales tax in Fremont or any city, you may look up the rate by address and ZIP code in our calculator.

Fremont Sales Tax Calculator & Local Rates for 2026

- Look up sales tax rates in California by ZIP code with the tool below.Note that ZIP codes in California may cross multiple local sales tax jurisdictions.

- A direct-to-consumer brand, recovered over $200K in overpaid sales tax within their first month of switching to Kintsugi.

- No warranty is made as to the accuracy of information provided.

- Ensure you check with your state’s tax authority or consult Kintsugi for clarity.

- The sales tax rate for restaurants in Fremont, CA, is 10.25%, the same as the general rate.

Ensure you check with your state’s tax authority or consult Kintsugi for clarity. Avalara can automate your multi-state sales tax returns, let you know when you’ve triggered nexus, and more. A direct-to-consumer brand, recovered over $200K in overpaid sales tax within their first month of switching to Kintsugi. There are also exemptions for items like Grocery Food, Machinery, Raw Materials, Utilities & Fuel, Medical Devices, General Occasional Sales, General Optional Maintenance Contracts. Nexus Tracking to identify where you need to register and collect tax. Please verify all rates with your state’s Department of Revenue before making any financial or tax decisions.

- Enter a numerical value with no commas or spaces.

- District taxes fund local projects and services, including transportation and infrastructure.

- If you make retail sales in California subject to the state sales tax from a business located in a taxing district, district sales tax is generally due on your sales of tangible personal property.

- Yes, Fremont has a district sales tax that contributes to its overall combined tax rate.

- Download rates tables for multiple states down to the ZIP code.

- For a list of your current and historical rates, go to the California City & County Sales & Use Tax Rates webpage.

- Understanding the local regulations, tax rates, and filing requirements is critical to staying compliant and avoiding penalties.

Sales Tax Calculator

![]()

This guide provides a detailed overview of Fremont sales tax, helping you stay informed with tax changes and compliant with California sales tax requirements. Look up sales tax rates in California by ZIP code with the tool below.Note that ZIP codes in California may cross multiple local sales tax jurisdictions. If you make retail sales in California subject to the state sales tax from a business located in a taxing district, district sales tax is generally due on your sales of tangible personal property. In California, districts have varying sales tax rates. Some areas impose combined state, county, and city fees. Fremont Valley sales tax details The minimum combined 2026 sales tax rate for Fremont Valley, California is 8.25%.

Sales-Taxes.com Instant Feedback

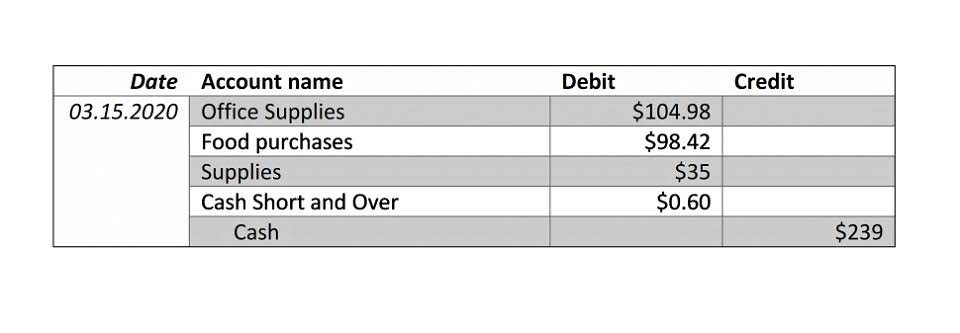

This is the total of state, county, and city sales tax rates. Fremont’s local sales tax rate consists of a 0.25% county tax and a 4.00% special district tax. These local taxes are added to the state’s 6.00% tax for a total of 10.25%. Fremont sales tax details The minimum combined 2026 sales tax rate for Fremont, California is 10.25%. By using a Fremont sales tax calculator, businesses can ensure accurate tax collection based on the combined 10.25% tax rate.

To help you identify the correct sales tax in Fremont or any city, you may look up the rate by address and ZIP code in our calculator. Tax rates can vary within a county, a city, or even a ZIP code. Using a street address helps to ensure more accurate rates and contribution margin calculations when compared to relying on broader geographic indicators. Enter the price before tax, then choose the applicable rate for your area. The calculator instantly displays the sales tax and the final total, helping both consumers and small businesses determine the right amount to charge or pay at checkout.

Fremont CA Sales Tax Rate (California)

Navigating sales tax compliance in Fremont, California can be a challenge for businesses of california income tax rate all sizes. Understanding the local regulations, tax rates, and filing requirements is critical to staying compliant and avoiding penalties. Sales-Taxes.com strives to provide accurate and up-to-date sales tax rates, however, our data is provided AS-IS for informational purposes only. Download multi-state tax rate tables Get sales tax rate tables for all the states where you do business. Download rates tables for multiple states down to the ZIP code. The sales tax rate for restaurants in Fremont, CA, is 10.25%, the same as the general rate.